On November 8, 2016 the Management Board of the Company adopted a new dividend policy of the Company, worded as follows:

“The main goal of the strategy of Cyfrowy Polsat S.A. Capital Group (the “Group,” “Polsat Group”) is the permanent growth of the value of Cyfrowy Polsat S.A. (the “Company”) for its shareholders. We intend to achieve this goal by implementing the major elements of our operational strategy which include:

- growth of revenue from services provided to residential and business customers through consistent building of the value of our customer base by maximizing the number of users of our services, as well as the number of services offered to each customer, while simultaneously increasing average revenue per user (ARPU) and maintaining high levels of customer satisfaction,

- growth of revenue from produced and purchased content by expanding its distribution, maintaining the audience shares of our channels and improving our viewer profile,

- effective management of the cost base of our integrated media and telecom group by exploiting its inherent synergies and economies of scale, and

- effective management of the Group’s finances, including its capital resources.

Predictable dividend payout to shareholders is one of the main goals underlying our capital resources management policy. To assure attractive profitability levels for the capital employed by our shareholders, while at the same time bearing in mind the strategy of deleveraging of the Group, the Management Board has set the desirable consolidated debt level, as measured by the net debt/EBITDA ratio, which should be reduced to below the level of 1.75x.

In view of the above, the Management Board of Cyfrowy Polsat S.A. has adopted a resolution regarding the dividend policy which assumes that dividend payout proposals, along with the Management Board’s recommendations, will be presented every year to the General Meeting, subject to the observance of the following principles:

- if the ratio of the Group’s net debt to consolidated EBITDA, as calculated for the end of the quarter preceding the quarter of adoption of the dividend payout resolution and while accounting for the impact that the proposed dividend payout will have on net debt, is lower than 3.2x but higher than 2.5x, then the Management Board of Cyfrowy Polsat S.A. will recommend a dividend payout in the range between PLN 200 million and PLN 400 million;

- if the ratio of the Group’s net debt to consolidated EBITDA, as calculated for the end of the quarter preceding the quarter of adoption of the dividend payout resolution and while accounting for the impact that the proposed dividend payout will have on net debt, is equal or lower than 2.5x but higher than 1.75x, the Management Board of Cyfrowy Polsat S.A. will recommend a dividend payout in the range from 25% to 50% of the Group’s consolidated net profit for the past financial year;

- if the ratio of the Group’s net debt to consolidated EBITDA, as calculated for the end of the quarter preceding the quarter of adoption of the dividend payout resolution and while accounting for the impact that the proposed dividend payout will have on net debt, is lower than 1.75x, the Management Board of Cyfrowy Polsat S.A. will recommend a dividend payout in the range from 50% to 100% of the Group’s consolidated net profit for the past financial year.

Every time when presenting a proposal of distribution of the profit, along with the recommendation, the Company’s Management Board will take into account the Group’s net profit, financial standing and liquidity, existing and future liabilities (including potential restrictions related to facility agreements and other financial documents), the assessment of the Group’s prospects in specific market and macroeconomic conditions, potential necessity of spending funds for the Group’s development, in particular through acquisitions and embarking on new projects, one-off items, as well as valid legal regulations. Moreover, given that a significant portion of the generated capital resources is obtained by the Group from dividends paid by its subsidiaries, the above mentioned policy and the Board’s recommendation will, in each case, be dependent on the financial situation of the Company’s subsidiaries and the Company itself.

The dividend policy will be subject to regular verification by the Company’s Management Board. In particular, the Management Board provides for a modification of the dividend policy following the refinancing of Polsat Group’s debt which is expected in 2020.

The new dividend policy will take effect from January 1, 2017, however the source for the dividend payout will be the Company’s net profit for the financial year ended December 31, 2016.”

Distribution of profit for 2015

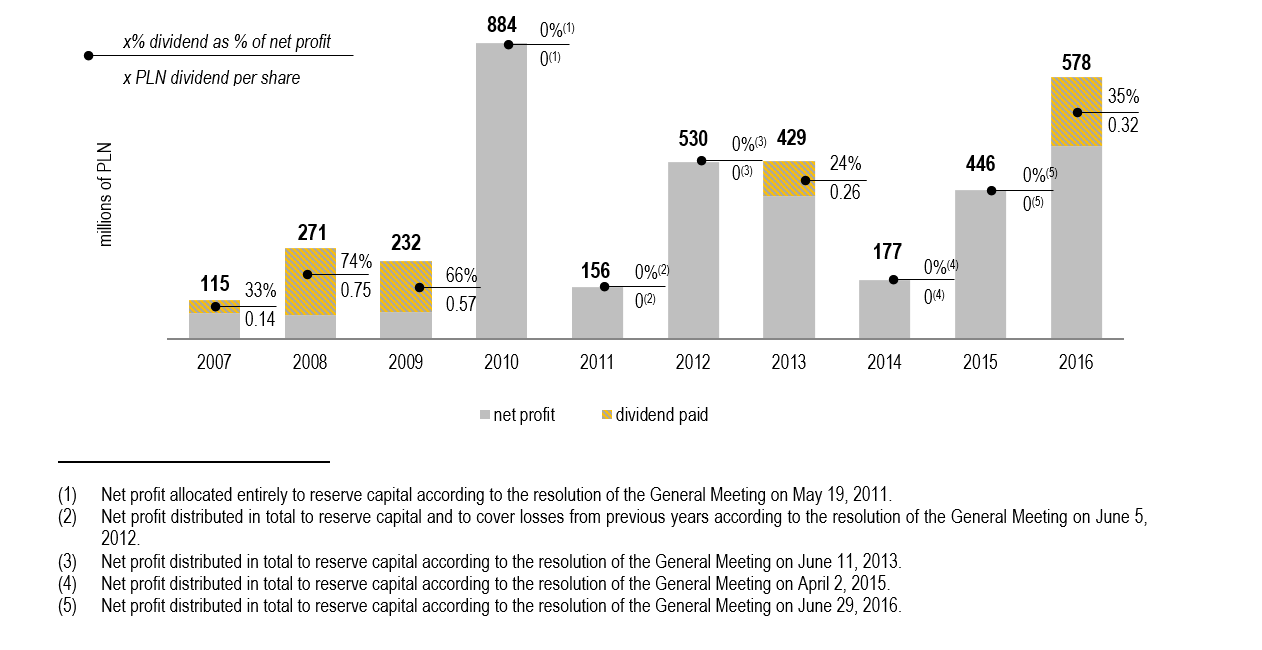

Acting in accordance with resolution no. 29 of the Ordinary General Meeting, held on June 29, 2016, regarding profit distribution, the Company’s total standalone net profit for the financial year ended December 31, 2015 in the amount of PLN 446.1 million was allocated to the reserve capital.

Profit distribution of 2016

On June 27, 2017 the Annual General Meeting of the Company adopted a resolution regarding the distribution of the Company’s net profit for the year 2017 in the amount of PLN 578 million, thus allocating PLN 204.7 million to dividends for shareholders of the Company and PLN 373.2 million to reserve capital. The dividend represented 35.4% of the Company’s net profit for the year 2016, while the value of dividend per one share amounted to PLN 0.32.

History of profit sharing